Electronic banking My Fibank

![]()

We Are Merging My Fibank & Fibank Token Apps

Confirm all transfers and operations in My Fibank application without the need to use another mobile application.

Advantages:

- Quick authorization of transfers without the need for an additional device

- PINt code for verification of all operations (transfers, operations, contracts and others)

- Self-assisted activation without the need to visit an office

- My Fibank becomes functionally equivalent to an electronic signature (QES), a hardware or software token for remote banking

- When logging in and verifying operations in the web version (fibank.bg), verification via Push notification or QR code scanning is required

Activation of the mobile application

With a few easy steps, you can activate My Fibank mobile application and create your global PINt code to use when logging into the application or signing operations:

1. Download My Fibank mobile application;

2. Enter your username and password;

3. Enter 6-digit code received by SMS in the activation field;

4. Create your global 4-digit PINt code;

5. Choose a preferred method of login and confirmation of operations in the application;

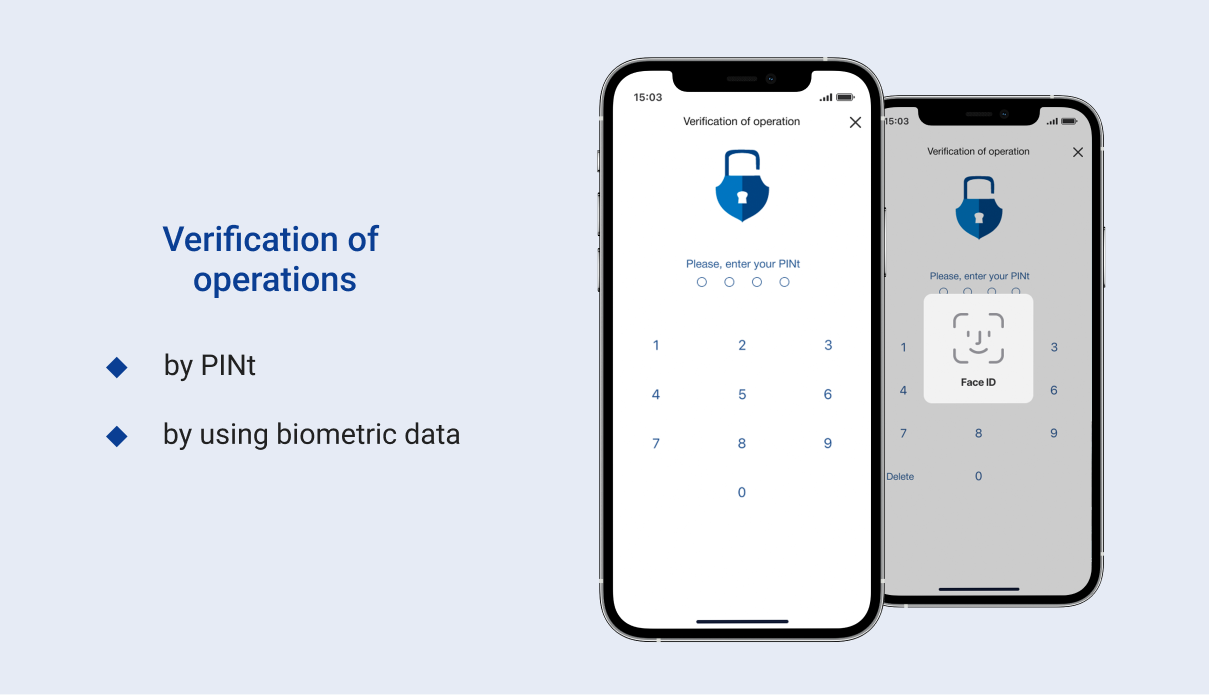

Login and verification of operations

After successful activation, login and verification can be done by PINt or by using biometrics (fingerprint or facial recognition).

Registration in My Fibank

To use My Fibank, you need to register as a user in one of the following ways:

- Online registration:

- registration and verification entirely online at fibank.bg for natural persons, who are holders of a debit or credit card issued by Fibank in their name;

- online request with office confirmation - you can make an online request for registration at fibank.bg, after which you need to confirm it at the Fibank branch most convenient for you.

- On site at Fibank branch

Note: If you already have an existing username, you can access other registrations for which you are a proxy by signing a document at a bank office.

More information about the registration process can be found in the Help menu on my.fibank.bg website

- Registration with verification from Evrotrust mobile application

The registration allows access to the full functionalities of active online banking.

Learn more about the remote signing of documents with a Qualified Electronic Signature (QES) from Evrotrust.

Dear clients,

We would like kindly to inform you about the following new functionalities in My Fibank electronic banking platform:

- Submitting an application for a housing/mortgage loan through My Fibank web version – submitting an application for a mortgage loan based on financial parameters entirely online through My Fibank. The application can be confirmed only with My Fibank password without the need for a Software/Hardware Token. A video consultation with our credit specialist is possible. The application is available on My Fibank web version for all individual clients by selecting the “Loans” menu.

- Possibility for delivery of newly issued cards by courier - delivery of debit and credit cards by courier to the address specified by the client. The option is active in all forms in My Fibank web and mobile application. The fee for the new service is BGN 10 / 5.11 EUR;

- Activation of cards delivered by courier in My Fibank web and mobile application. The activation process is quick, easy and secure;

- Purchase of electronic vignettes for cars and trailers through My Fibank web and mobile application. The functionality is available by selecting “Electronic Vignettes” menu.

Dear clients,

By signing remotely documents with a Qualified Electronic Signature (QES) from "Evrotrust", you can easily, quickly and conveniently, without visiting a bank office, to:

- register for My Fibank electronic banking with access to the full functionality of active remote banking;

- make a change in your registration related to obtaining the opportunity to perform active banking operations;

- apply for the issuance of a Fibank Token;

- register a mobile device for My Fibank mobile application, etc.

My Fibank electronic banking is a service through which you conveniently and easily manage remotely your personal or company finances. By using the My Fibank unified platform, you perform banking operations directly from your computer, smartphone or other mobile device having an Internet connection at a high level of security.

By using My Fibank you can:

- You apply for a consumer loan entirely online;

- Apply for a new debit card to a new or existing account;

- Apply for a new/renegotiate the limit of an existing credit card;

- Receive your debit/credit card at the address specified by you, delivered by courier;

- Activate a card received by courier quickly, easily and securely;

- Apply for a mortgage loan based on financial parameters entirely online;

- Purchase electronic vignettes for cars and trailers;

- Order all types of transfers with up to 50% lower fees than the bank's standard fees and commissions;

- Pay utility bills and taxes to Sofia Metropolitan Municipality from your registration as an individual person;

- Order transfers from a file and periodic transfers;

- Open and close current accounts and deposits in BGN and foreign currency;

- Negotiate a preferential exchange rate and buy foreign currency;

- Monitor balances and movements on current accounts and deposits in real time;

- Receive information about card payments even before they are posted (card authorizations);

- Receive your monthly credit card statements online;

- Receive credit card statements and checking account statements by email;

- Register for "3D Card Security" service;

- Export the data from your statements in different formats - excel, pdf or html for easier data processing;

- Legal entities can perform mass transfers.

We offer you the following terms:

- registration and maintenance of the service free of charge;

- access to the system only with password and username*;

- payment of utility bills and taxes to the Sofia Metropolitan Municipality only with a password and without a fee;

- online statements and monitoring your bank accounts - free of charge.

* To ensure a higher level of information protection, we recommend using more complex access passwords.

Signature Tools:

To carry out active banking operations through My Fibank, you need to use one of the following signature tools, depending on your personal preferences:

- Fibank Token

- Token device

Limit levels for operations through My Fibank:

Limit levels are the maximum amounts up to which each customer can carry out transactions through My Fibank. Limit levels are valid for individual customers and are as follows:

- daily limit of BGN 100,000 or its equivalent in another currency;

- a weekly limit for account for the execution of payment operations in the amount of BGN 200,000 or their equivalent in another currency.

Any individual client who wishes to perform payment operations at limits other than those set by the Bank can change them by personally submitting an application to a Fibank office and setting their own personal limits for payment operations.

Limits for Transactions Initiated Through Third Party Providers (TPP):

The bank executes payments initiated through Third Party Providers for an amount/s up to the BGN equivalent of EUR 15,000.00 (fifteen thousand euros) or its equivalent in another currency.

Key features of the application:

- NEW: Application for a debit card to an existing bank account or to a completely new standard current account for individual customers. Possibility to apply for cards for children and teenagers, as well as microcards in bracelets.

- NEW: Possibility to deliver newly issued cards by courier - delivery of debit and credit cards by courier to the address specified by you. The fee for the new service is 10 BGN / 5.11 EUR.

- NEW: Activation of cards delivered by courier - fast, easy and secure.

- NEW: Purchase of electronic vignettes for motor vehicles and trailers.

- Active banking by legal entities

- You can bank through the application securely, quickly and conveniently, confirming transactions up to certain limits with a password, and above them with a Token device.

- For active banking it is necessary to register your mobile device in order to bank securely, quickly and conveniently, confirming transactions up to certain limits with a password, and above them with a Token device.

- Deactivating/ Reactivating a card – by selecting this option will temporarily limit your card from making payments. You can reactivate the card whenever you want.

- Blocking a card – by using this operation, your card will be blocked without being able to be reactivated again. This service is used for lost or stolen cards.

- Payment of obligations for utility services for individual users.

- Cash desk operations for individual users - possibility for deposit, withdrawal and request for availability of funds from a convenient Bank office.

- Ability to make transfers in the country and abroad with just one click. The smart payment system leads you from the beginning of the transaction to its successful completion. To make banking more quickly and easily, you have the possibility to use templates to your payments. With just one click you can copy and to order transfers.

- Minors from 14 to 18 years old owners of Teen card can take advantage of the application to make transfers between own accounts (Current account and Smart Teen account).

- You get a full and detailed statement on your accounts - check the balance, the amounts of the received and ordered transfers, the opening dates, etc. We made sure that all statements to be presented visually with comfortable graphics.

- You are always informed about your deposits - with the application you can easily see the accumulated interest to the moment, to check the date of maturity and the days remaining to maturity.

- You can easily manage your credit and debit cards - monitor all payments made by them, the available funds you have on your card accounts, which is the utilized credit limit on your credit cards, etc. You can repay the amounts due on your credit cards with just one click.

- Digitalize your Mastercard® cards:

- in Apple Wallet for iOS users

- in My Fibank application for Android users*.

* The service is not supported by the version of the application offered by AppGallery.

- In addition you have the ability to determine and change your limits for card transactions without need for visiting a bank office. The limits are valid and running immediately after the change and the service is totally free.

- You can quickly locate branches and ATMs of Fibank through the map in the application - you can easily locate which are our closest branches and ATMs, see their working hours and contact details and use Maps to get quickly to them. For your convenience, we have uploaded latest pictures of our branches and offices.

- Information on exchange rates - you can monitor in real time "purchase rate" and "selling rate" of Fibank for the currencies with which the Bank operates.

- Offers - here first for the users of the application we shall publish updated information about new products and services or ongoing promotions. Follow us to stay informed before everyone else.

- You can select Settings and your work with the application will be even more convenient and enjoyable. For more information - see your account in the application and the "Settings" menu.

We did not forget your security:

You have various options to choose limits of transactions and security settings such as duration of session, change the type of banking, etc.

From the application settings you can select:

- The Policy for signature of active operations:

- all transactions with Token device;

- transactions up to set limits for the application with a password for login and/or biometric data.

- The Policy for login:

- with username and password for login and/or biometric data;

- with username and Token device.

- The duration of validity of the session in the application. It is not recommended unjustified long session.

Limit levels for transactions:

- Limit levels for individuals, for payment operations made through the mobile application My Fibank (valid until 29.09.2020). See here

- Limit levels for individuals, for payment operations made through the mobile application My Fibank (valid from 30.09.2020). See here

- Limit levels for legal entities, for payment operations made through the mobile application My Fibank. See here

Supported operating systems:

The application is available for iOS and Android, with mandatory minimum requirements for the version set by the developers (the Bank).

The minimum requirements at the moment are: Android OS v.8.0 and iOS 13.0.

My Fibank mobile application is available for free download from the catalog with applications supported by the respective operating system (currently Google Play and AppStore).

My Fibank mobile application is available for free download from the catalog with applications supported by the respective operating system (currently Google Play and AppStore).

- General Terms and Conditions of First Investment Bank AD for Electronic banking "My Fibank" pdf 200.89 KB

- Request for registration/change/termination of registration in the electronic banking "My Fibank"(individuals) pdf 416.85 KB

- Request for registration/change/termination of registration in the electronic banking "My Fibank"(business clients) pdf 417.5 KB

Legal entities

- Sample form of Power of attorney for a legal entity for registration, change and termination of registration for remote banking doc 42.5 KB

- Sample text of a power of attorney for legal entities for passive distance banking doc 43.5 KB

- Sample text of a power of attorney for legal entities for active distance banking doc 46 KB

Limit levels for transactions

- Limit levels for individuals, for payment operations made through the mobile application My Fibank valid until 29.09.2020 pdf 144.03 KB

- Limit levels for individuals, for payment operations made through the mobile application My Fibank valid from 30.09.2020 pdf 146.66 KB

- Limit levels for legal entities, for payment operations made through the mobile application My Fibank pdf 145.98 KB

Fibank

Fibank